![]() 613-769-2623 or 613-715-0730

613-769-2623 or 613-715-0730

![]() 613-769-2623 or 613-715-0730

613-769-2623 or 613-715-0730

Ottawa’s housing market closed out the year with a typical December slowdown in activity.

Sales softened further, reinforcing the cautious tone that emerged this fall. Inventory levels declined, while prices remained broadly stable. Despite a quiet finish in November and December, annual sales in 2025 ended 1.3% higher than in 2024 by total sales, and 4.1% higher than 2024 by total dollar volume, pointing to a year defined by balance and overall stability.

The year followed an unconventional seasonal pattern, beginning with a delayed spring, transitioning into a steady summer that avoided the usual mid-year dip, and then moderating again through the fall and early winter.

Ottawa continues to show resilience compared with the price corrections seen in some larger Canadian markets. December data suggests a market that is holding steady, offering buyers more choice while maintaining generally steady conditions. That said, market performance continues to vary meaningfully by property type, with the condo segment remaining the softest area of the market.

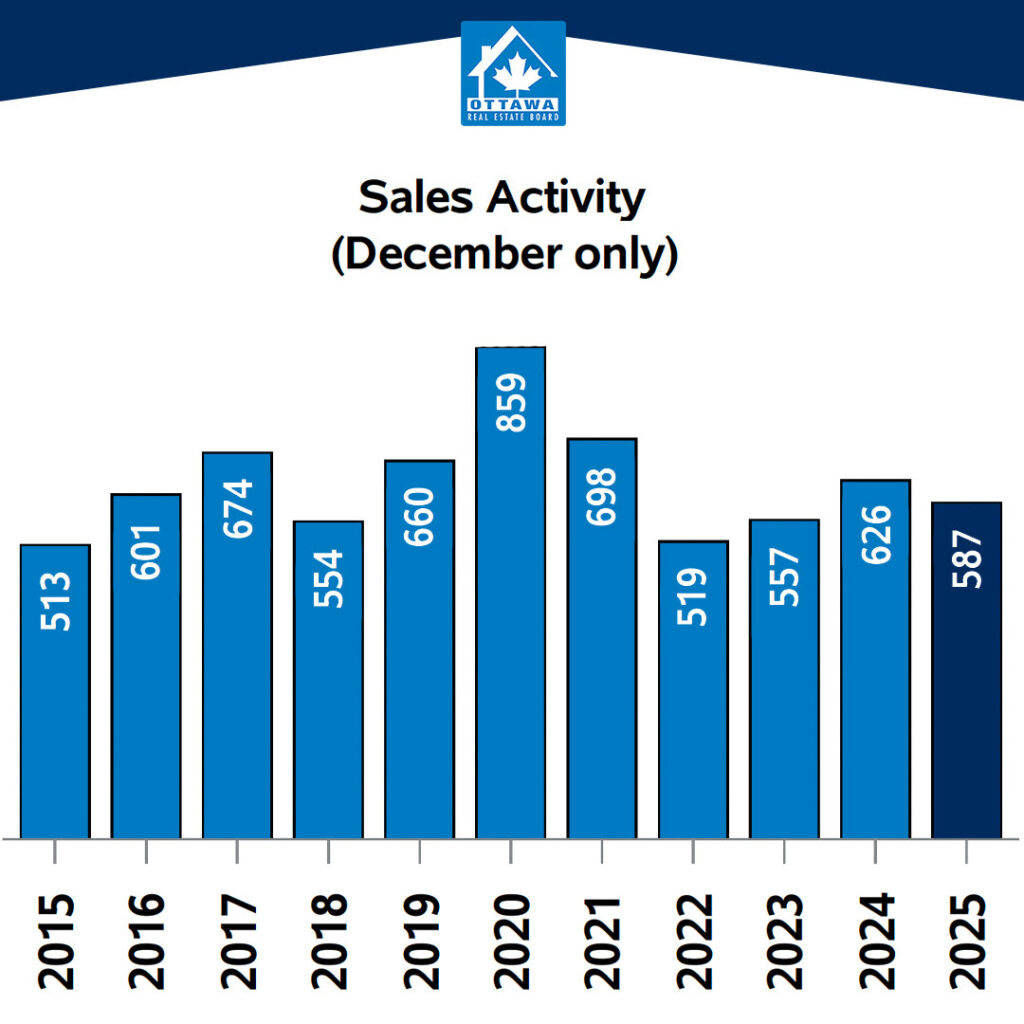

In December, 587 residential properties sold, down 32% from November but consistent with typical December activity when excluding the unusually strong pandemic markets of 2020 and 2021. Since 2018, average December sales (excluding those two years) have been 583 units. While the slowdown reflects normal seasonal patterns, it also points to continued buyer caution.

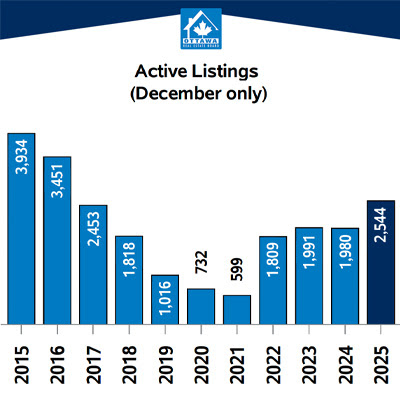

On the supply side, new listings declined as expected, and active listings fell from 3,628 in November to 2,544 in December, reflecting the usual holiday-season slow down. Even so, inventory levels remain elevated compared with recent December norms, continuing the trend seen throughout the fall of increased choice for buyers.

Since 2022, Ottawa has seen a multi-year trend across all market segments toward higher year-end inventory levels. While seasonal absorption typically limits a sharp buildup of listings in December, it has not fully offset the higher volume of inventory entering the market earlier in the year. Year-to-date active listings in December 2025 were 19% higher than last year, 45% higher than 2023, and 89% higher than in 2022. Months of inventory rose to 4.3, higher than last December and closer to long-term, pre-pandemic averages.

Prices remained relatively stable in December. The average residential sale price was $658,943, essentially unchanged from December 2024. This follows November’s modest year-over-year increase and reflects a market where prices are being supported, but not driven higher.

The MLS® Home Price Index offers additional context. The composite benchmark price has declined month over month since the summer, yet still finished 2025 slightly above 2024 levels overall. This suggests price adjustment is occurring gradually at the benchmark level, even as averages prices continue to be influenced by the mix of homes sold.

In December, detached homes continued to outperform townhomes and condos. Prices remained comparatively stable, with supply balanced with 4.3 months of inventory. The single-family benchmark price posted a 0.4% year-over-year increase, underscoring the resilience of this segment.

Limited availability and consistent demand continue to support detached homes, which remain the anchor of Ottawa’s market stability.

The apartment segment remains the softest part of the Ottawa market, with December data reinforcing trends seen in November. Sales activity remained subdued, while months of inventory climbed to nearly eight, well above balanced levels.

© BEAULIEU TEAM 2020 | ROYAL LEPAGE PERFORMANCE REALTY